Ministry of Finance published the measure about the report on income tax information

With effect from 22 June 2023, the Measure No. MF/006455/2023-74 on the report on income tax information enters into force by which the Ministry of Finance of the Slovak Republic (the „Ministry “) stipulates the content, arrangement, and electronic format of the report on income tax information.

As we have informed in our previous article, amendment to the Act on Accounting introduced a new obligation for selected accounting entities to disclose a report on income tax information. However, the content of this report was not defined. Now, the Ministry specified the content and structure by issuing the measure.

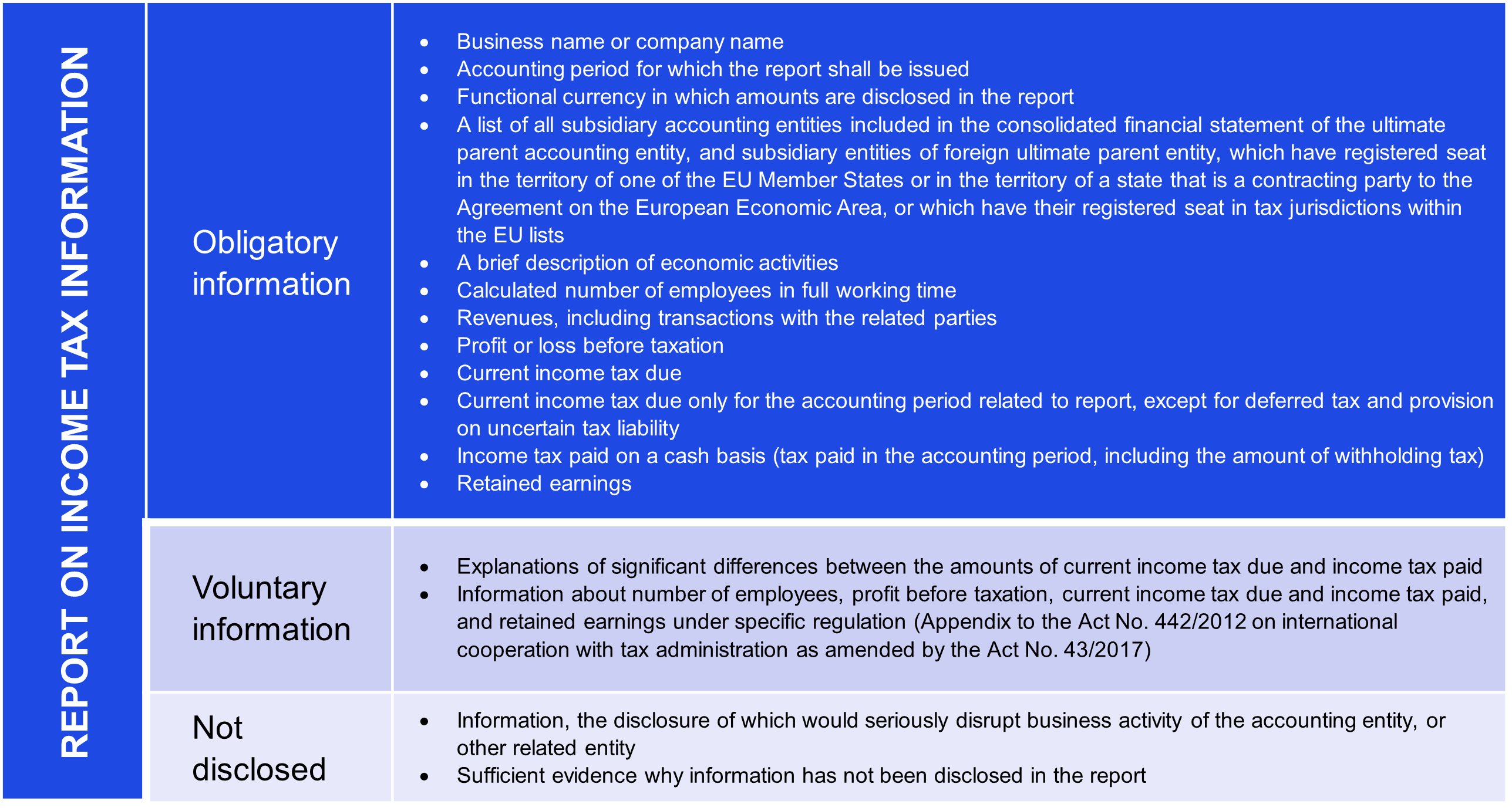

According to published measure, the report on income tax information includes all information about all activities of standalone accounting entity, ultimate parent accounting entity, and foreign ultimate accounting entity. Information included in the report can be divided in three groups as follows:

- Obligatory information,

- Information which can be disclosed, and

- Information which does not have to be disclosed.

The following table below shows an overview of these information which shall include in the report on income tax information.

In addition to the content of report on income tax information, the structure of disclosed information is also important. Information about accounting entity shall be reported separately for each Member State, separately for each tax jurisdiction of EU states that does not cooperate for tax purposes, and separately for each tax jurisdiction of cooperative EU states, otherwise, aggregately for tax jurisdictions.

The Ministry also set an obligation that the report must be filed at the Register in electronic, machine-readable formats. The report with the abovementioned content shall be filed with the Register for the first time for the accounting period starting on 22 June 2024, or later.

Do you have a question? Write us.

Our experts will answer your questions