Changes in First Aid from 1 July 2021

On 9 June 2021, the Government of the Slovak Republic approved a proposal to change the conditions and extend the period of implementation of the First Aid project aimed to support and maintain jobs during the time of the State of Emergency and the elimination of their consequences.

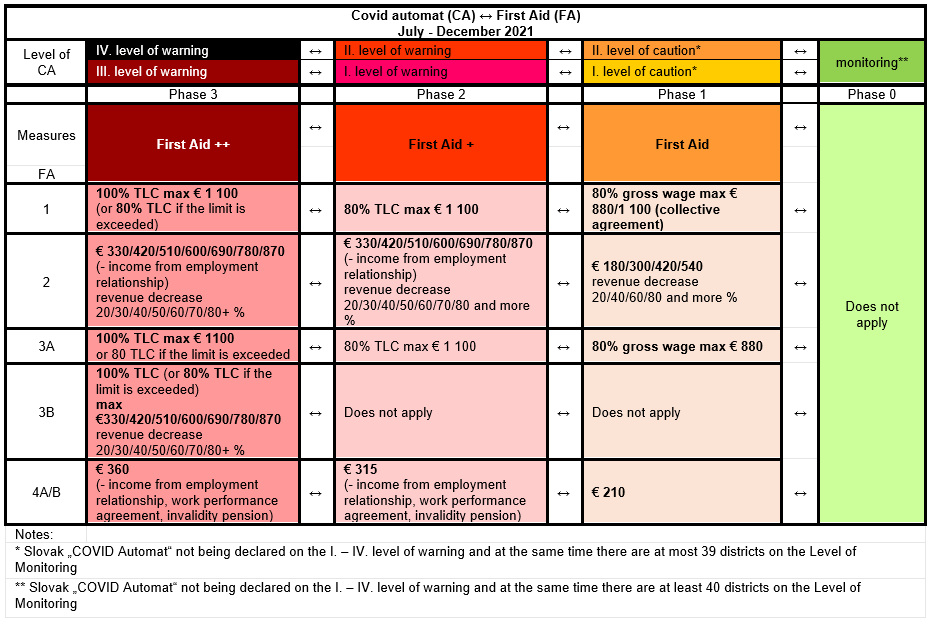

Although the current epidemiological situation in Slovakia is developing positively and the economy is gradually recovering, the Ministry of Labour, Social Affairs and Family of the Slovak Republic has decided to extend the period of providing financial aid to employers and self-employed persons, to support sustainability of the jobs. The most significant change is to link the financial aid to the „COVID Automat, i.e. the amount of the contribution will depend on the current epidemiological situation in a particular district. If the applicant meets the stipulated requirements, it is possible to apply for the contribution until the end of 2021, i.e. until the bill that addresses the introduction of permanent regime of abbreviated work, the so called „Kurzarbeit“ becomes effective.

In the following section, we list the basic conditions for drawing First Aid with link to „COVID Automat“:

Phase 3 (burgundy and black)

In case of epidemiological situation being on the III. and IV. level of warning according to the Slovak „COVID Automat“, contribution to employers and self-employed persons will be provided according to the rules of the project First Aid ++, including Measure 3B. Employers who manage to sustain job positions will receive a contribution to reimburse the wage costs per employee in the amount of 100% of the total price of work. According to Measure 3B, self-employed persons and employers can apply for a flat-rate contribution of up to € 870.

Phase 2 (red and pink)

In case of epidemiological situation being on the I. and II. level of warning according to the Slovak „COVID Automat“, contribution to employers and self-employed persons will be provided according to the rules of the project First Aid +, except for Measure 3B. Employers can apply for contribution of 80% of the total price of the employee’s work. During this phase, employers will not be able to apply for flat-rate contribution under the Measure 3B. According to Measure 2, self-employed persons are entitled to contribution up to € 810.

Phase 1 (green)

If the Slovak „COVID Automat“ is not being declared on the I. to IV. level of warning and at the same time there are maximum of 39 districts on the Level of Monitoring, employers and self-employed persons will be provided a contribution according to rules of the project First Aid, except for Measure 3B. Employers can apply for contribution to reimburse wage costs per employee in the amount of 80% of gross wages. As in the Phase 2, employers will not be able to apply for flat-rate contribution according to Measure 3B. According to Measure 2, self-employed persons are entitled to contribution up to € 540.

Phase 0 (green)

If the Slovak „COVID Automat“ is not being declared on the I. to IV. level of warning and at the same time there are at least 40 districts on the Level of Monitoring, the aid does not apply.

As the Slovak „COVID Automat“ is updated on weekly basis, in order to simplify the system of contributions payment , the aid scheme will be set for the whole calendar month according to the prevailing number of days in the individual stages during a given calendar month. In case of equality of the number of days in particular month, a more favorable model will be applied. The transition between specific phases during one month will be possible by a maximum of two phases.

The Ministry of Labour, Social Affairs and Family will publish on a monthly basis up-to-date information about applicable level of the aid scheme in particular districts.

Do you have a question? Write us.

Our experts will answer your questions